GST Registration

Get ARN Number within 3 Working Days

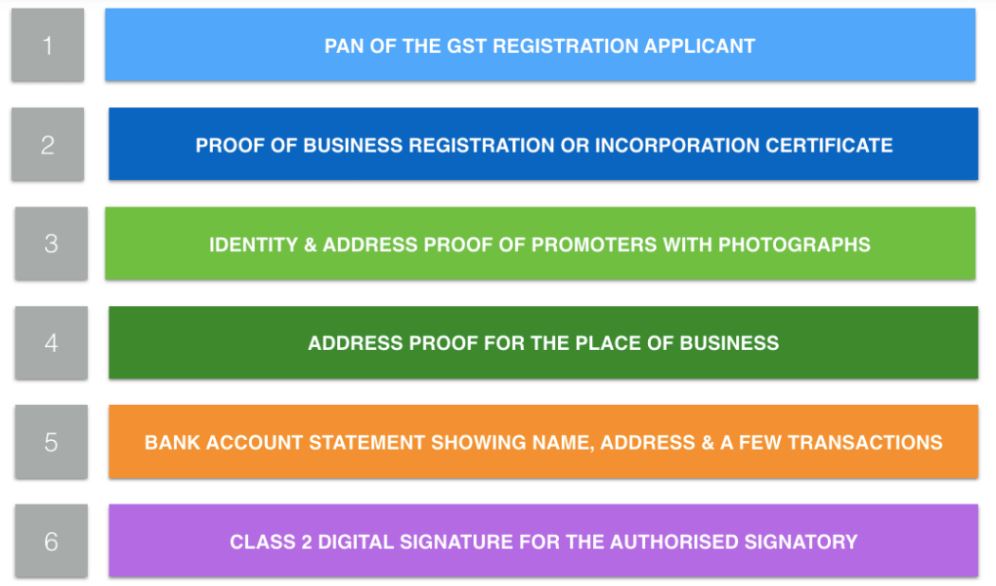

Documents Required For GST Registration

Documents Required for Regular Taxpayers

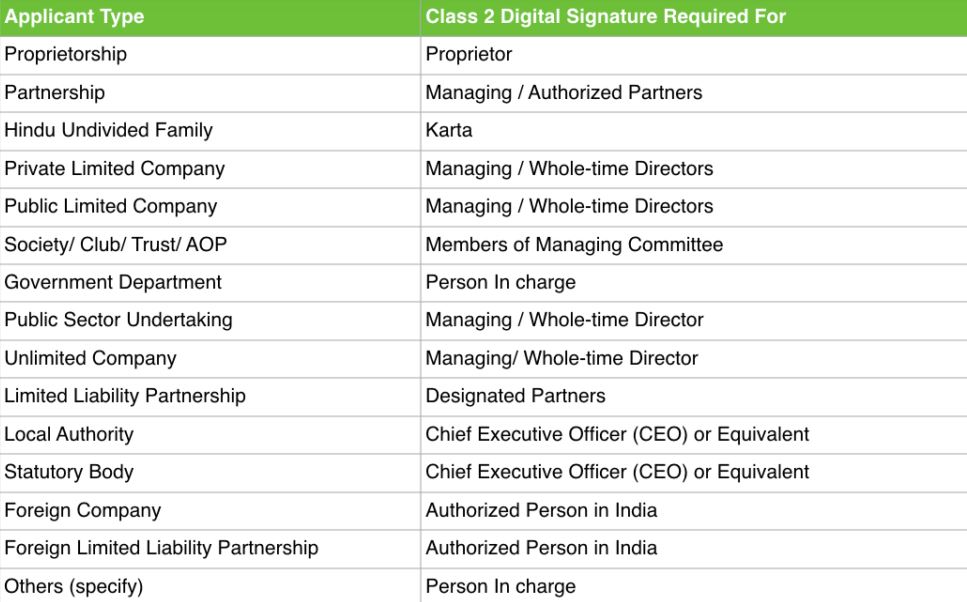

Authorized Signatory

Procedure for obtain GST Certificate

1. Select Service

2. Fill Up the Form

3. Make Online Payment

4. Experts Will Process your Form

5. Get Your Certificate on your mail.

Faq's on GST

All businesses that successfully register under GST are assigned a unique Goods and Services Tax Identification Number also know as GSTIN.

If a business operates from more than one state, then a separate GST registration is required for each state. For instance, If a sweet vendor sells in Karnataka and Tamil Nadu, he has to apply for separate GST registration in Karnataka and TN respectively.

A business with multiple business verticals in a state may obtain a separate registration for each business vertical.

Small businesses having an annual turnover less than Rs. 1.5 crore** ( Rs. 75 Lakhs for NE States) can opt for Composition scheme.

**CBIC has notified the increased in the threshold turnover for opting into the Composition Scheme from Rs 1 crore to Rs 1.5 crores. The notification will be effective from 1st April 2019.

Composition dealers will pay nominal tax rates based on the type of business:

- Composition dealers are required to file only one quarterly return (instead of three monthly returns filed by normal taxpayers).

- They cannot issue taxable invoices, i.e., collect tax from customers and are required to pay the tax out of their own pocket.

- Businesses that have opted for Composition Scheme cannot claim any Input Tax Credit.

Composition scheme is not applicable to :

- Service providers

- Inter-state sellers

- E-commerce sellers

- Supplier of non-taxable goods

- Manufacturer of Notified Goods

This scheme is a lucrative option for all SMEs who want lower compliance and lower rates of taxes under GST.

A GST taxpayer whose turnover is below Rs 1.5 crore** can opt for Composition Scheme. In case of North-Eastern states and Himachal Pradesh, the present limit is Rs 75 lakh.

Turnover of all businesses registered with the same PAN should be taken into consideration to calculate turnover.

**CBIC has notified the increased in the threshold turnover for opting into the Composition Scheme from Rs 1 crore to Rs 1.5 crores. The notification will be effective from 1st April 2019. Learn the Rules about Composition scheme & Know the pros & cons of being a composition dealer.

Obtain GST registration and file CMP-02 to opt-in for the scheme.

A. For normal registered businesses:

- Take input tax credit

- Make interstate sales without restrictions

- To know more about the Benefits of GST

B. For Composition dealers:

- Limited compliance

- Less tax liability

- High working capital

- To know more about composition scheme

C. For businesses that voluntarily opt-in for GST registration (Below Rs. 40 lakhs*)

- Take input tax credit

- Make interstate sales without restrictions

- Register on e-commerce websites

- Have a competitive advantage compared to other businesses

- To know more about voluntary registrations

*CBIC has notified the increase in threshold turnover from Rs 20 lakhs to Rs 40 lakhs. The notification will come into effect from 1st April 2019.